Virginia’s beautiful waterfront properties, river communities, and coastal locations offer incredible lifestyle benefits until you try to sell them.

If your Virginia property is in a flood zone, you’ve probably discovered that “water views” and “flood risk” create a complicated relationship in today’s real estate market. Between mandatory flood insurance, lender requirements, and buyer concerns, flood zone properties face unique selling challenges.

Here’s what every Virginia flood zone property owner needs to know about selling when water risk becomes a deal killer.

Understanding Virginia’s Flood Zone Reality

Virginia’s High-Risk Areas

- Hampton Roads: Extensive FEMA flood zones due to sea level rise

- Richmond Area: James River flooding affects thousands of properties

- Northern Virginia: Potomac River communities in high-risk zones

- Eastern Shore: Coastal flooding from Atlantic storms

- Tidewater Region: Rising seas and storm surge risks

Types of Virginia Flood Zones

Zone AE (High Risk)

- 1% annual chance of flooding (100-year floodplain)

- Base Flood Elevation established by FEMA

- Flood insurance is required for federally-backed mortgages

- Most restrictive for new construction

Zone X (Moderate to Low Risk)

- 0.2% annual chance of flooding (500-year floodplain)

- Flood insurance is optional but recommended

- Lower premiums than in high-risk zones

- Still affects property values and buyer perception

Zone VE (High Risk Coastal)

- Wave action plus flooding risk

- Velocity zones with additional building requirements

- Highest insurance costs

- Most challenging to finance and sell

Recent FEMA Map Updates

Virginia flood maps have been updated significantly:

- More properties added to high-risk zones

- Base flood elevations increased in many areas

- New coastal velocity zones are designated

- Grandfathering benefits are lost for some properties

Why Virginia Flood Zone Properties Struggle to Sell

The Insurance Shock

Flood Insurance Requirements

- Federally-backed mortgages require flood insurance in high-risk zones

- Annual premiums range from $400 to $4,000+, depending on risk

- Separate from homeowners’ insurance (additional monthly expense)

- Cannot be canceled without refinancing to a non-federally backed loan

Insurance Cost Examples (Annual Premiums)

- Hampton Roads Zone AE: $1,200-2,400/year

- Richmond River property: $800-1,600/year

- Northern Virginia Potomac: $1,000-2,000/year

- Coastal Zone VE: $2,000-5,000+/year

Lender Complications

Mortgage Requirements

- Flood insurance must be in place before closing

- Coverage amount must equal the loan balance or the property value (whichever is less)

- Lender-placed insurance if the borrower doesn’t obtain (extremely expensive)

- Escrow requirements for insurance payments

FHA/VA Loan Challenges

- Additional inspections for flood zone properties

- Elevation certificates are required for accurate insurance quotes

- Property condition standards more strict in flood zones

- Appraisal complications due to flood risk

Buyer Psychology Problems

What Flood Zone Means to Buyers

- Future flooding will definitely happen (statistical certainty)

- Insurance costs will only increase over time

- Resale challenges when they want to sell

- Potential property damage and displacement

Climate Change Concerns

- Sea level rise is making coastal flooding worse

- Stronger storms are increasing flood frequency

- FEMA map updates likely to expand flood zones

- Long-term insurance viability questions

Virginia-Specific Flood Zone Challenges

Hampton Roads: The Sea Level Rise Crisis

Norfolk/Virginia Beach Reality

- The highest rate of sea level rise on the East Coast

- Sunny day flooding is becoming common

- Military installations affected (buyer pool concerns)

- Insurance rates are climbing annually

Market Impact:

- Properties selling 10-20% below comparable non-flood zone homes

- Longer marketing time (6+ months typical)

- Deal failures occur when buyers discover insurance costs

Richmond Area: River Flooding Legacy

James River Communities

- Hurricane flooding history (Gaston, Isabel, Florence)

- Urban development is increasing runoff and flood risk

- Historic properties with grandfathered insurance are losing benefits

- Gentrification is bringing flood awareness to previously ignored areas

Market Challenges:

- Buyer education is required about flood insurance

- Historic flood events affecting property values

- New flood zone designations surprise sellers

Northern Virginia: Potomac River Properties

High-Value Flood Risk

- Expensive properties with expensive insurance

- The government buyer pool is aware of climate risks

- New construction competition with elevated foundations

- HOA issues in waterfront communities

Selling Complications:

- Luxury expectations vs. flood zone reality

- High property taxes plus flood insurance costs

- Sophisticated buyers are doing flood risk due diligence

Eastern Shore: Coastal Erosion + Flooding

Double Risk Properties

- Storm surge plus regular tidal flooding

- Erosion reduces lot sizes over time

- Limited buyer pool for rural coastal properties

- Infrastructure problems (roads, bridges) during floods

Traditional Sale Challenges for Flood Zone Properties

The Financing Nightmare

Lender Requirements Timeline

- Flood determination is required early in the mortgage process

- An elevation certificate may be needed (cost: $500-800)

- Insurance quotes are required before closing approval

- Policy in place before funding

Common Deal Killers

- Insurance cost shock: Buyers discover $200+/month flood insurance requirement

- Lender requirements: Additional inspections or elevation requirements

- Appraisal problems: Comparable sales affected by flood risk

- Timing issues: Insurance policies not ready by the closing date

Buyer Pool Limitations

Who Still Buys Flood Zone Properties

- Cash buyers (no lender requirements)

- Investors planning rentals

- Local buyers familiar with flood risks

- Waterfront enthusiasts are willing to pay for the location

Who Avoids Flood Zone Properties

- First-time buyers shocked by insurance costs

- VA/FHA buyers facing additional requirements

- Out-of-area buyers unfamiliar with local flood history

- Families concerned about safety and displacement

The Hidden Costs of Flood Zone Property Ownership

Insurance is Just the Beginning

Flood-Related Expenses

- Annual insurance premiums ($400-4,000+)

- Deductibles for flood damage (often $1,000-5,000)

- Elevation certificates for insurance rating

- Flood-resistant materials for renovations

- Sump pumps, generators for flood preparation

Regulatory Compliance Costs

- FEMA requirements for substantial improvements (50% rule)

- Elevation requirements for renovations

- Permit complications in flood zones

- Building code compliance is more expensive in flood areas

Property Value Impacts

Flood Zone vs. Non-Flood Zone Values

Research shows flood zone properties typically sell for:

- 5-10% less in moderate-risk areas

- 10-20% less in high-risk coastal zones

- 20%+ less after actual flood events

- Longer marketing time (3-6 months additional)

Cash Sales: The Flood Zone Solution

Why Cash Buyers Work Better for Flood Properties

No Lender Complications

- No flood insurance required for cash purchase

- No elevation certificates needed for closing

- No appraisal problems with flood risk

- No financing timeline delays

Realistic Market Pricing

- Factor in flood risk appropriately

- Account for insurance costs in pricing

- Price for a limited buyer pool reality

- Include future flood zone expansion risks

We Understand Flood Zone Properties

Virginia Flood Experience

- Purchased 50+ flood zone properties across Virginia

- Understand insurance markets and requirements

- Know which areas have the highest/lowest risk

- Realistic pricing based on actual flood history

No Surprises or Renegotiation

- Price includes flood risk from the initial offer

- No inspection contingencies to reduce price

- No lender requirements to derail closing

- Close in 14 days regardless of flood zone

Flood Zone Property Planning Strategies

If You’re Staying: Risk Management

- Elevate utilities above the base flood elevation

- Flood-resistant materials for renovations

- Emergency planning for family and property

- Insurance reviews are annually for rate changes

If You’re Selling: Timing Considerations

Best Times to Sell Flood Properties

- Spring/early summer before hurricane season

- After rate map updates, but before implementation

- Before major flood events affect buyer psychology

- During low-flood years, when risk seems abstract

Worst Times to Sell

- After major flooding in your area or region

- During hurricane season (June-November)

- After FEMA map updates increase risk zones

- When flood insurance rates spike significantly

Areas We Serve |

🏠 Northern Virginia Cash Home Buyers

Primary Counties:

- Fauquier County, Virginia – Fast closings for homeowners in any situation

- Prince William County, Virginia – As-is purchases with no repair requirements

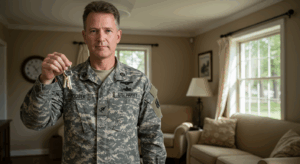

- Fredericksburg, Virginia – Specialized solutions for military personnel with PCS orders

- King George County, Virginia – Estate and inherited property solutions

🏛️ Central Virginia Cash Home Buyers

Major Markets:

- Richmond County, Virginia – Investment property and rental home solutions

- Henrico County, Virginia – Divorce and distressed property specialists

- Chesterfield County, Virginia – Pre-foreclosure assistance and fast closings

- Colonial Heights, Virginia – Property damage and renovation avoidance solutions

🌾 Additional Service Areas

Expanding Coverage:

- Caroline County, Virginia – Rural property specialists

- Powhatan County, Virginia – Historic home and unique property solutions

- Goochland County, Virginia – Land and development property purchases

- Culpeper County, Virginia – Investment property exit strategies

- Hanover County, Virginia – Quick solutions for job relocations

- Hopewell, Virginia – Water and fire damage property solutions

- Louisa County, Virginia – Vacation and second home sales

- Orange County, Virginia – Farm and agricultural property specialists

Ready to Sell Your Flood Zone Property?

Flood zone properties offer beautiful living but challenging sales. If yours has become more of a burden than a blessing due to insurance costs, buyer concerns, or flood risk, you have options.

Get your no-obligation cash offer for your Virginia flood zone property:

Call (540) 787-3300 or get your free assessment

We’ll provide a fair cash offer within 24 hours that realistically factors in flood risk. We understand Virginia’s flood zones and can close in 14 days without insurance requirements or financing complications.

Because waterfront living is extraordinary until it’s time to sell.

We Buy Houses Virginia – Flood zone property specialists 24 Synan Rd STE 117, Fredericksburg, VA 22405 | (540) 787-3300

Fair. Fast. No Fees. – Understanding Virginia flood risks since 2019.

Questions Virginia Flood Zone Owners Ask

For traditional sales, yes. But cash buyers often don’t require them, saving you $500-800.

Flood risk is increasing, making cash sales often the most viable option for flood zone properties.

Flood zones are about statistical risk, not flood history. Insurance requirements are the same regardless.

Map updates typically increase risk zones rather than decrease them. Waiting often means more restrictions.

Yes, we buy flood-damaged properties and factor repair costs into our offers.